ALL IN ONE MEGA PACK - CONSIST OF:

Industrial Property Development Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

INDUSTRIAL PROPERTY DEVELOPMENT REAL ESTATE PROFORMA TEMPLATE INFO

Highlights

Creates 5-year Industrial Property Development proforma real estate, profit and loss statement template excel, financial statements, and financial ratios in GAAP or IFRS formats on the fly. Used to evaluate a Industrial Property Development business before selling it. Unlocked- edit all.

Easy-to-use yet robust Industrial Property Development pro forma excel template. With minimal planning experience and very basic knowledge of Excel, you can impress investors with a proven, strategic Industrial Property Development business plan.

Description

The purpose of the Inventory Control Software Financial Projection Template Excel: Construction of the Industrial Property Property, Manage Industrial Property revenues and expenses, Sell the Industrial Property Property, distribute the equity via GP/LP with IRR hurdles.

Build an Industrial Property Property, Manage Industrial Property Property Revenues, and Expenses, Sell the Property, Distribute the Equity via GP/LP with IRR hurdles.

This Inventory Control Software Excel Pro Forma Template is built for real estate investors looking at construction projects. However, it could be useful for financial analysts or students looking to improve their real estate financial modeling skills.

It is ready to use financial model with on the fly calculations. It provides a complete analysis of potential Industrial Property Property construction.

User-friendly design streamlines the assumptions entering process up to 10 minutes.

INDUSTRIAL PROPERTY DEVELOPMENT REAL ESTATE MODEL REPORTS

All in One Place

This Industrial Property Development reit financial model will give the business visionaries financial assumptions with respect to expenses and pay that can be united to get the business' full picture.

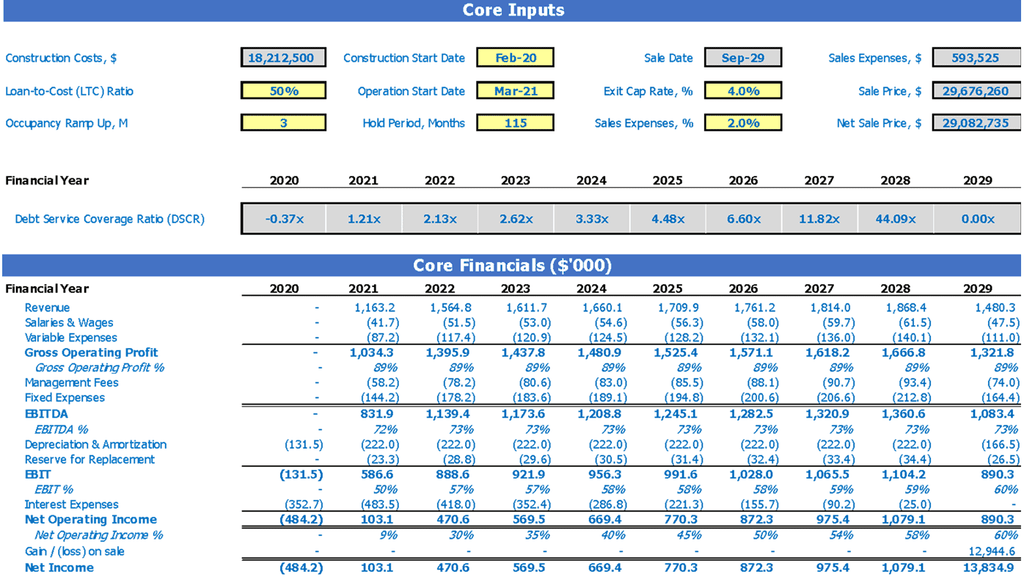

Core Inputs

On this tab you can input main assumptions for your business: acquisition date, purchase price, operation start date, hold period, loan-to-value ratio, exit cap rate, sales expenses, occupancy ramp up period, and assumptions for the sensitivity analysis

Equity Waterfall with IRR hardles

Enter equity contributions for the General Partner and Limited Partner as well as 3 IRR hurdles

Property Metrics

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

NOI & EBITDA

Net Operating Income and EBIDTA chart

Property Inputs

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

INDUSTRIAL PROPERTY DEVELOPMENT REAL ESTATE FINANCIAL ADVANTAGES

NOI based property Exit calculations

Industrial Property Cash Flow: includes operating revenues, operating costs, NOI, capital costs, debt service, and net income

Core Metrics: DSCR, Cash on Cash Return, IRR, Equity Multiple, Net Profit

Steady Growth distribution of Soft Costs by individual line item

Cash Flow for 10 years by months